Blog post

Retail media: Competing with leading online media platforms

For retailers, media monetization increasingly represents a unique opportunity to fund innovations and accelerate digital transformation. The massive traffic and highly-qualified audience provided by their e-commerce websites can bring outstanding value for brands and their agencies to execute effectively against their media strategies at the tip of the marketing funnel and can unlock significant incremental revenue streams for retailers.

The numbers are staggering. In 2020, brands invested nearly $60 billion globally in e-commerce advertising. This is the equivalent of 1.4% of global retail e-commerce gross merchandise value.1 And for leading pure players like Alibaba or Amazon, or for traditional retailers that are the most mature and advanced in retail media, site monetization represents the equivalent of up to 4.5% of their online revenue.2

Amazon, which launched their media business in 2015, alone made an estimated $18 billion in advertising revenue in 2020,3 making them the third-largest player in the online media space in the U.S. In a few years, they have succeeded in capturing 10% of the digital advertising business, mainly at the expense of Google and Facebook. Obviously, the reason why they’re so interested in media monetization is profitability; ad tech expert Benedict Evans suggests they may have an operating margin of over 60%.

There's also an incredible opportunity for leading traditional retailers to compete effectively by taking control over their media monetization strategy and launching their own private ad networks. Kroger — who is the largest grocery retailer in the U.S., in the top 10 list of e-commerce players and one of the fastest growing — is a great example. With Kroger Precision Marketing – which has been partnering with Microsoft PromoteIQ since 2018 — Kroger gives advertisers the necessary tools and options to harness the wealth of first-party data and accurately target their desired audiences. During the presentation of their financial results for Q4 2020, Kroger’s CEO mentioned retail media as one of the two main drivers of the accelerated growth of their operating profit.

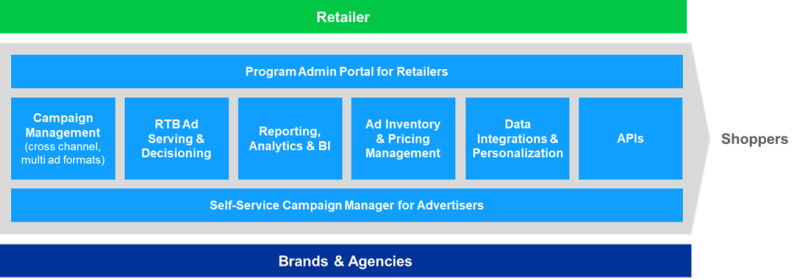

The potential is still quite extraordinary; to look at the industry is to see the opportunity. E-commerce has boomed over the last few years, and even more since the beginning of the pandemic. The ongoing shift from traditional marketing to online advertising and the search for performance will only continue. The deprecation of third-party cookies will require alternative spigots for customer information and targeting in trusted environments. All of this will lead to an acceleration of budget shifts in favor of retail media. However, to seize this opportunity fully, retailers need a thoughtful approach and a robust media platform. Running a few dozen campaigns on a limited number of ad placements is relatively easy but scaling media monetization requires a sophisticated technology stack and skillset.

Structure of modern retail media technology stack

For a retailer, earning several tens or hundreds of millions of dollars in advertising revenue means fiercely competing for marketing budgets with the leading online media platforms. If they want advertisers to invest massively and sustainably into their private ad networks, retailers should expect brands and their agencies to be continuously pushing to get more features and functionalities to express their media strategies effectively and achieve their marketing and sales goals. That includes targeting customers and personalizing ads, easily setting up and managing campaigns, and accessing deep analytics capabilities to measure performance and improve return on ad spend (ROAS). As retail media grows, brands will be very mindful about where they invest.

Alex Sherman, CEO and co-founder of PromoteIQ, which was acquired by Microsoft in 2019, will be at DMEXCO @home 2021 on September 7 with Marc Opelt, CEO of Otto, one of the largest e-commerce companies in Europe. In that session, entitled “Trusted Partnerships in future commerce strategies,” they’ll be having a conversation about retail media and how software solutions like Microsoft PromoteIQ are helping Otto accelerate its digital transformation. A recording of the session will be made available on demand following the event.

Resources

To learn more about Microsoft PromoteIQ commerce marketing, visit the Microsoft PromoteIQ website.

For more information about DMEXCO @home 2021, visit the event website.

To keep up to speed automatically with news, vertical and seasonal insights, tips and tricks, thought leadership, and product updates, sign up for the weekly Microsoft Advertising Insider newsletter.

[1] WARC, Global Ad Trends: The pivot to e-commerce, and Microsoft internal data, 2020.

[2] Microsoft internal data.

[3] WARC, Global Ad Trends: The pivot to e-commerce, 2020.

Your input makes us better

Take our quick 3-minute survey and help us transform your website experience.