Blog post

Unwrap four new insights to reach last minute shoppers

As holiday consumers make final gift giving decisions—by reading reviews, comparing prices, searching curated lists online, and window shopping at the mall—advertisers are preparing for the final shopping moments of 2023. From developing Cyber-5 marketing plans in the cloud to creating lists on whiteboards with snappy Black Friday campaign names. And with so many platforms and devices to reach shoppers, plus a sleigh full of advertising methodologies to choose from, Microsoft Advertising is here to help by answering the top 4 advertiser questions of the festive season sprint. Whatever way you plan your campaigns, we look forward to your incredible success.

I have not seen a peak in revenue yet. Should I be concerned?

No. If you have not seen a peak in revenue yet—great news. Now is the time revenue spikes will emerge because this year consumers are waiting for Black Friday and Cyber Monday deals.1 And that time is upon us.

Holiday sales, on average, represent 20 percent of annual sales across most industries.2

In fact, the National Retail Federation forecasts that this year holiday spending in the US will reach record levels during November and December with a growth between 3% and 4% over 2022 to between $957.3 billion and $966.6 billion. And according to Statista.com, total retail sales (online and in-store) during Christmas season was forecast to reach 84.9 billion British pounds in the United Kingdom (UK), making this the largest festive season spender. In Germany, retail spending during Christmas is predicted to reach about 74 billion British pounds (close to 85 billion Euro).

What makes this year different from last year?

Over 2/3 of US shoppers are spending the most time looking for coupons and deals.1

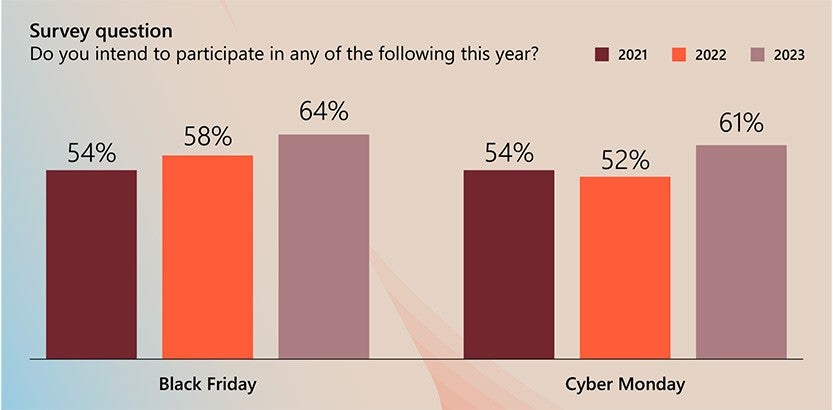

Deal-seeking is a major trend this holiday season. Black Friday and Cyber Monday are part of what has become known as the ‘Cyber-5’, the important retail days including Thanksgiving, Black Friday, Small Business Saturday, Sunday (the only one that has kept its name) and Cyber Monday. Our research shows that more shoppers are planning to wait for the Black Friday and Cyber Monday deals than in previous years, which aligns to the deal-seeking behaviour outlined in our October whitepaper Your Festive Season Marketing Playbook.

Microsoft Gifting Survey 2023, Total Respondents in 2022, n=1019; 2023, n=1015 1. Confidence Internal = 95%

Which roles does search play in online and in-store purchases?

Search continues to be a crucial component in every decision-making process, facilitating both online and in-store purchases. It enables the discovery of new retailers, pre-purchase research of products, price comparisons, and much more.

60% of Gen X consumers say they use search to find the best prices.1

This is also confirmed in Path to Purchase 2023, released by eMarketer. According to this research, shoppers are most likely to turn to search engines regardless of where they first discovered the new brand or product. In-store discovery drives the highest rate of instant purchases—31.5% will purchase a new brand or product immediately after discovering it in-store—but search and other digital activities play an important role in the consideration stage.

EMEA deal-seekers spend +33% more time searching, compared to the average shopper.3

Microsoft Gifting Survey 2023, Total Respondents in 2022, n=1019; 2023, n=1015 Microsoft Gifting Survey 2023, Total Respondents in 2022, n=1019;2023, n=1015; Those planning to purchase ”mostly in store” reported a significant drop, down 6 percentage points, 95% CI.

What this means is that search is giving you a great opportunity to target Cyber-5 shoppers. And Microsoft Advertising is giving you access to 14 billion global monthly searches to target, so make sure to keep your Microsoft Advertising campaigns turned on during these important retail days. Moreover, Windows audiences on our network have a higher buying power index compared to the total internet population,4 making it a must-buy this holiday season.

What can be expected post Cyber-5?

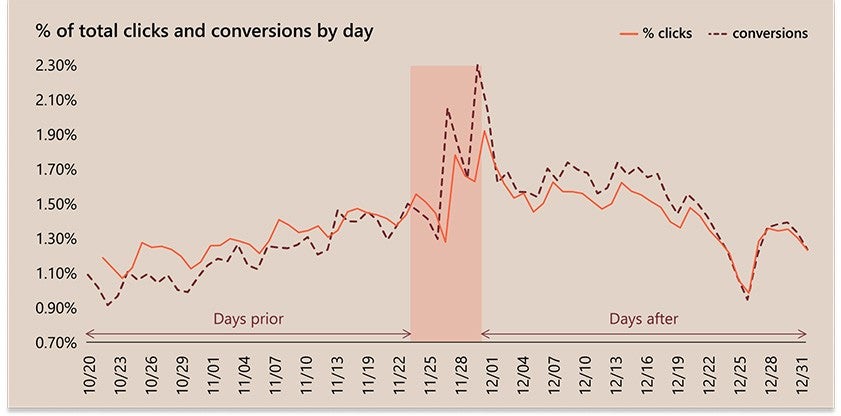

There’s more good news. Search volumes after Cyber-5 don’t immediately drop and will remain high while CPCs are lower. That means that if you’ve missed out on revenue during Cyber-5, you can still compensate for it during the following days. Our research shows that 43% of holiday clicks, and 46% of holiday conversions, occur after Cyber-5. Also, CPAs after Cyber-5 are roughly 13% lower than prior periods.5

Microsoft Internal. US Only. 2022.

This means that you gain a significant opportunity to increase sales after Cyber-5. Make sure to keep your Microsoft Advertising campaigns running. Also, don’t forget to activate your Shopping Campaigns, because consumers exposed to both Product Ads and Search Ads are 11.5 times more likely to convert.

Lastly, we see that search volumes for returns accelerate two days after Christmas (Tuesday December 27). This will continue into the new year with a peak on Tuesday December 31, tapering off by Tuesday February 14. Make sure your business plans for those returns.

Your holiday planning checklist

Launch campaigns now—shopping starts early this year

- Turn on remarketing campaigns to ensure your Shopping campaign has an ‘All Products Target’ and use Dynamic Search Ads page feeds to target any holiday related URLs or Holiday Promotional items.

Lead with value messages and promotions to draw out deal-seekers

- Our research shows that search volume for gift cards will increase by 18 percent, while search volume for expedited shipping will increase by 5 percent. Ensure gift cards are included in your Shopping Feed and include expedited shipping in applicable site links. Also, leverage Merchant Promotions through product ads and Promotion Extensions for text ads to call out your deals.

Act fast using AI to personalize offerings

- Use the power of Multimedia Ads—our responsive ad format—to amplify product discovery, inspire action, and build loyalty. And if you’re looking for creative ideas for this Holiday Season, just ask Copilot in Bing for help.

Use your store to support profitable online growth

- Diversify your ad strategy and ensure that you communicate a unified message through all of your marketing channels. Use Local Inventory Ads to provide an opportunity to shoppers to purchase your products in your nearby stores. And don’t forget to opt-in to our Partner Network and update your ‘Mobile Device Modifiers’ to increase your reach.

Want to learn more?

We are here to help you succeed this holiday season. Ask your Account Manager for personalized tips and download the Festive Holiday Season Marketing Playbook for 30 pages of the best tips and tricks. If you want to learn more about targeting shoppers with Audience Ads, check out this 40-minute on-demand webcast.

Wishing you all a great and successful holiday season.

[1] Microsoft Gifting Survey 2023

[2] National Retail Federation, 2023

[3] Microsoft internal data UK, Germany, France, Spain, Italy, the Netherlands

[4] Comscore Custom Reporting, Aggregated browser, US, Sept 2020 to Dec 2020.

[5] Microsoft internal, US only, 2022

Your input makes us better

Take our quick 3-minute survey and help us transform your website experience.