Spring is a time of regeneration, growth, and development. From blooming flowers to launching new ad campaigns, to taking those first steps towards a personal New Year’s resolution. In line with the new beginnings of spring, we are introducing a new blog series: Seasonal Spotlights. Our vision is to empower advertisers of all sizes each season with relevant, actionable insights and best practices that help reach their desired customers.

Microsoft Advertising is transforming too. Evolving from our search roots into an omnichannel, end-to-end AdTech powerhouse.

Advertisers can now find new ways to grow and connect with customers through experiences like generative AI that redefine how audiences finds answers on the open web. Thanks to our data-driven solutions, they can also connect with engaged audiences at their most receptive moments across search, display, native, video, Connected TV (CTV), and retail media.

Connect with exclusive Microsoft and partner placements with brands like LinkedIn, Netflix, and generative-AI powered Edge and Xbox and reach your audience anywhere their journey takes them. Advertisers can also reach over one billion people on Microsoft Start, Microsoft Outlook, Microsoft Casual Games, and Microsoft 365 globally.

Spring insights: Home and Garden

The Home and Garden industry is a dynamic and competitive market, where consumers are constantly seeking products and services to improve their living spaces. Understanding how consumers search and shop online is crucial for marketers who want to reach and convert effectively.

Spring insights: top shopping categories

Whether it’s the garden, exterior home repairs, or interior upgrades, advertisers have endless opportunities to reach customers who are ready to buy. Our research shows that purchasing behaviour differs among age groups and countries.

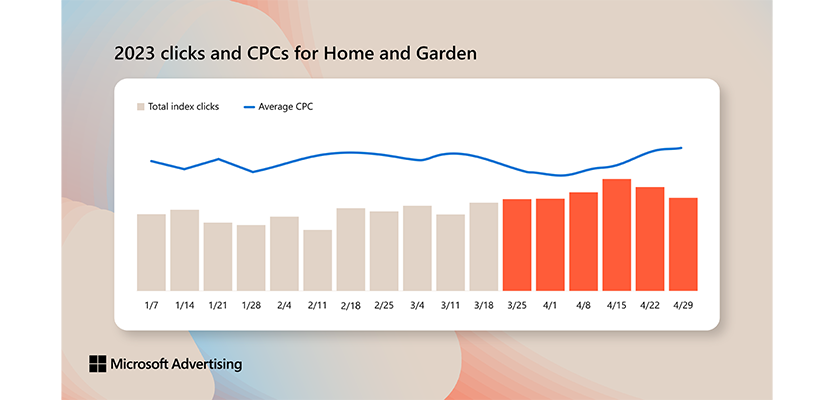

Even before spring arrives, people are ready to get outside and into the garden. This is great news for advertisers as Home and Garden related searches and clicks increase

as soon as the New Year begins. Clicks ramp up following the first day of spring as well. Whilst those clicks are increasing, the cost per click remains relatively low, making the first day of spring a sweet spot for advertisers’ acquisition campaigns. Those cost per clicks will increase and peak at the tail end of May.

The best news for Home and Garden advertisers is that clicks will remain high throughout spring and mid-summer.

In addition to sprucing up the garden, spring is prime for home improvement projects and spring cleaning. Based on our early projections,

we expect that search and click volumes will remain like last year, however, some categories are projected to exceed the overall vertical forecasts:

- Outdoor: Backyard maintenance products (e.g., gardening accessories, pest and weed control) and equipment (e.g., lawn mowers, leaf blowers) are projected to lift in the spring.

- Home improvement: Searches and clicks within the home improvement will continue to rise, driven primarily by searches for trademark brand terms.

- Restoration and repair: General contracting, construction, rebar and materials, and roofing and materials are predicted to rise year-on-year this season.

- Home security and safety: Projected growth in this category is mostly attributed to home security alarm systems and home surveillance products.

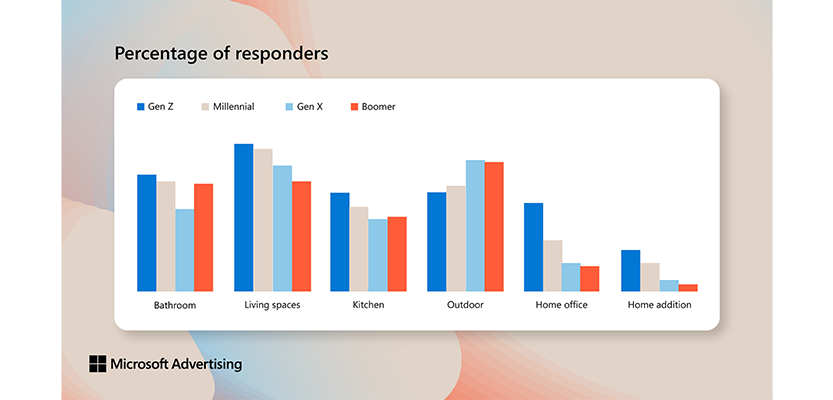

Our research highlights

interesting differences in preferences between generations. For example, Gen Z and Millennials are more likely to update their indoor living spaces than other generations. Gen X and the Boomer generation are more likely to spend time working on their outdoor space.

And when we look at last year’s data, we can also see slight differences between countries:

- In the US,

‘Yard, Garden & Patio’ related searches went up by 70% month-over-month (March to April 2023), whilst ‘Home Appliances’ and ‘Home Decor’ related searches showed a 32% month-over-month increase.

- In Germany,

‘Yard, Garden & Patio’ related searches were also the top performers with a 55% month-over-month increase, followed by ‘Kitchen and Dining’ with a 24% month-over-month increase and ‘Home Appliances’ with a 23% month-over-month increase.

- In France,

‘Yard, Garden & Patio’ related searches went up by 52%, followed by ‘Home Decor and & Interior Decorating’ with a 24% month-over-month increase and ‘Home Appliances’ with a 23% month-over-month increase.

- In Australia,

where people are getting ready for Autumn, search queries related to indoor spaces perform well. ‘Kitchen and Dining’ related searches saw an increase of 30% month-over-month (March to April 2023), followed by ‘Home Furniture’ and ‘Home Appliances’, both with a 25% month-over-month increase.

Spring insights: customer journeys

It’s no secret that mapping the customer journey can be challenging. The great news for advertisers is that our data shows Home and Garden customer journeys are becoming slightly shorter.

The research shows that in 2022 the average number of searches in a consumer’s Home and Garden journey was 77 searches, whilst the average for 2023 was 76 searches. And the average number of days between the first search and the converting click was 41 days in 2022, whilst this was just 38 days in 2023.

From garden tools and seeds to roofing materials and new alarm systems, people are performing general searches on Home and Garden topics. At the start of the Home and Garden journey, 57% of first clicks

come from a non-brand search and 71% of middle clicks come from a non-brand search. Only at the final converting click we see brand outpace non-brand; 38% of those clicks come from non-brand vs. 62% from a branded search. In other words, last click models undervalue the critical role non-brand plays in the early journey. Funding both query types is the best way to yield a conversion out of the customer journey.

And making the journey as easy as possible will certainly help you drive more conversions. Images can help with that. According to research conducted by Microsoft,

58% of respondents said they found inspiration through online images. That means advertisers have a better opportunity to stand out this year with Audience Campaigns with rich lifestyle imagery showcasing their products.

How to target your audience

Advertisers know a winning strategy is built on consumer behaviour insights, specific keyword targeting, tailored ad types, and more. Follow these timed steps to maximise your reach and impact this spring for your desired Home and Garden customers.

February – Early March (preparing for the spring season)

- Advertisers will find themselves in a competitive landscape, especially when it comes to search advertising, as they tend to default to search for their Home and Garden campaigns. Based on our own internal data

we expect Audience Ads to grow and serve as an opportunity to lay groundwork in this competitive landscape, because of its unique offering that advertisers cannot find elsewhere. Our advice is to invest extra budget in Audience Ads upstream whilst also promoting loyalty programmes and areas of business that are most important to stay competitive this season.

- Launch Video and Connected TV ads to reach drive increased brand awareness in advance of the peak so you are top of mind for consumers. Reach your audience as they are watching videos online, browsing the web or streaming their favourite shows on connected devices.

- Non-brand searches are common at the start of the season. Leverage image ads to target those search queries and nurture feed-based peaks.

- Think of these audiences when building your campaign strategy: In-market Audiences, Similar Audiences, Predictive Targeting.

March (search ramp begins)

- Focus on Search and Audience Ad budget optimisations to capture early searchers. Users who see both Audience and Search Ads from Home and Garden advertisers are 3.4 times more likely to visit

the Home and Garden advertiser’s site. They are also 8.7 times more likely to engage in a conversion behaviour. Promote key sub-verticals that are likely to rise this season, like outdoor, home improvement, restoration and repair and home security and safety.

- The journey is long, so optimise budget to capture early searchers, leveraging remarketing lists to target users who have visited your site previously.

- Consider beginning a ramp for a complementary Performance Max campaign (which are in open beta with Microsoft Advertising and will be available to all users in March) to help you capture more conversions.

- Think of these audiences when building your campaign strategy: In-market, Similar, Remarketing, Custom Audiences, Customer match.

April – July (searches and conversions peak)

- Bid up during key moments, refine targeting and budget mix to maximise conversions. Maintain a balanced Search Ad strategy with funding across major formats.

- Search clicks ramp at the start of spring and again speckled throughout summer. Bid up Image Ads 2-4 weeks prior to spring to maximise the opportunity. Audience Ad conversions peak in the first week of April, so increase bids in this key window of time.

- Feed-based ads are a key lower-funnel ad type. They can help you guide clients over the finish line to conversion throughout the season.

- Think of these audiences when building your campaign strategy: Custom audiences, customer match, remarketing, dynamic remarketing, predictive targeting (Audience ads only).

By following these Home and Garden best practices, you can now fully optimise your online marketing strategy.

Help us improve Microsoft Advertising

Your comments and feedback are integral to shape and improve our product. You can use the Microsoft Advertising Feedback portal, in-product feedback, Twitter or Instagram, and as always, contact Support.