Recent lockdowns across the world have imposed restrictions on closing travel and personal mobility. However, Travel is a resilient industry in Europe, and it has made many comebacks from recessions, terrorism, and political instability in recent years.

Naturally, with lockdown easing and air bridge announcements being made, there is a rise in curiosity about the new normal in travel. To better analyse the returning demand from consumers, a

travel demand recovery series has been created for you.

The below key findings provide a useful checklist for advertisers to connect to these consumers as they continue to use search to secure travel plans.

Brand loyalty has taken a strong hit

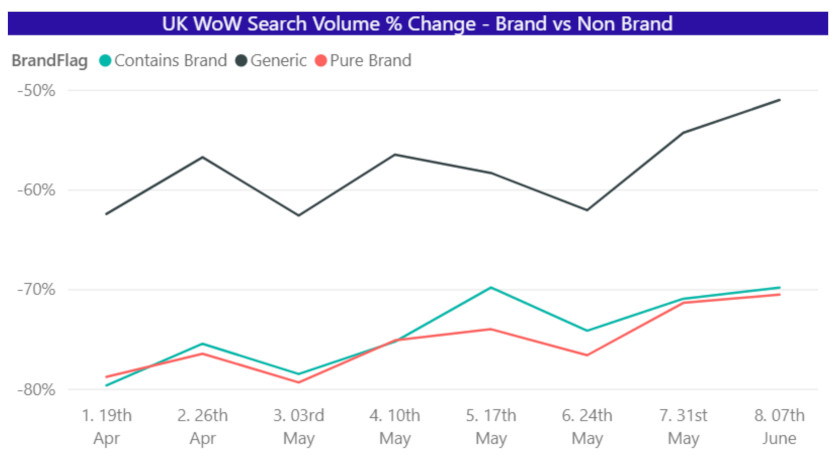

Across Europe (UK, France, Germany, Netherlands, and Spain),

brand search volume has a slower rate of growth and recovery compared to non-brand search volume.

Branded searches are recovering beneath generic searches with the gap widening, with lockdown easing. For example, in the UK, the lag in brand search recovery is dragging down overall search volume recovery with a notable current year-on-year gap of -40%.

This implies recovering travel search volume is being fuelled by generic searches and consumers are increasingly open minded about brands they consider and research.

Brand Search Evolution in Travel, Global

Domestic travel is signalling recovery in Europe

Our analysis of domestic travel searches suggests that across Europe (UK, France, Germany, Netherlands, Italy, and Spain), lockdown easing has amplified

domestic travel search demand from May onwards.

Despite borders reopening across Europe throughout June, effectively permitting international travel, domestic travel demand displays strong search momentum. As summer travel searches grow, a surge for accommodation verticals such as hotels, vacation rentals and camping are taking place. Destinations driving this domestic demand are also highly diverse, ranging from large cities, coastal sites, and more secluded areas of natural beauty.

The following report provides great additional insights for each European country.

Travel recovery overview, Europe

Your top 6 travel ads tips

The following recommendations will help you make the most of the travel season this year:

- Re-activate your campaigns to target re-opened destinations

- Leverage Responsive Search Ads to adjust to changing consumer preferences

- Use automated bidding to stay on top of the dynamic marketplace

- For recent visitors, prioritise remarketing and remarketing lists with more recent frequencies (e.g. 1, 3, 7, 14, 30 days) to target consumers who started to investigate holidays and trips

- Use Dynamic Search Ads to capture emerging queries

- And last, but not least, dial up on generic keywords as consumers continue to use non-branded searches to find what they need

While we provide a regularly updated snapshot of consumer behaviour trend changes and trends across EMEA, we understand it may be helpful to review the information more frequently, or for a specific country or region. You can view all our recent trends analyses in our

COVID Hub for more vertical insights on consumers behaviour shifts through COVID-19.