The festive break is just around the corner and whilst shoppers are busy hunting for the perfect present purchase, we have had our eye on what happens once the shopping is done, the bubbly is open, and 2015 rolls in!

Whilst the everyday consumer may have got their shopping mojo back this festive period, their thoughts do not stray far from the realisation that, sooner rather than later, they will have to settle their holiday season bill. Thoughts of turkey, presents and Father Christmas turn to budgeting, loans, credit cards, and insurance.

At Bing Ads, we are here to help finance and Insurance marketers in the UK get their finance campaigns in tip-top condition before the nation’s collective finance hangover kicks in. Below are four of our top tips.

#1: Take advantage of lower prices for finance clicks on Yahoo Bing Network

Yes, I am going to say it, I can’t keep this secret much longer: Bing Ads finance keywords are cheaper than Google AdWords!

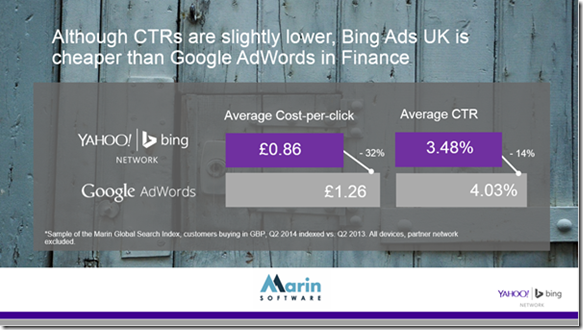

Don’t just take my word for it, the cross-channel performance advertising platform Marin Software has provided vertical benchmarking data. This study shows average click-through rates (CTR) and cost per click (CPC) across a sample of Marin Software’s customers buying in GBP in Q2 2014, as compared to the same customers’ experience in the same period on Google.

The data shows that whilst CTR for finance is typically slightly lower on the Yahoo Bing Network - at 14% lower than Google AdWords - the prices are significantly cheaper. Average CPC was -32% vs. Google AdWords in finance, demonstrating a more efficient use of budget and the clear cost advantage of using Yahoo Bing Network.

2#: Understanding the seasonality - are you ready for the finance product peaks?

There are many sub-verticals within finance, and often marketers canstart to feel a bit like a juggler under the pressure of not dropping the ball when it comes to seasonality. This is especially true if you are a brand or marketer who covers many different financial products and services.

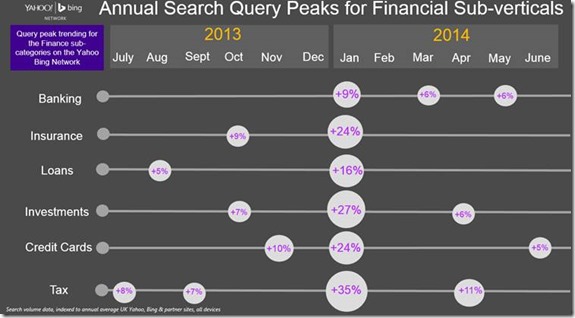

As expected, financial queries trend up in the January period, but we thought it would be of interest to provide an annual perspective on query trends for all the finance sub-categories, so that you can plan for the upticks outside of January.

The data below shows the top query % increases for the core finance sub-categories on the Yahoo Bing Network across the year, shown vs. the annual average.

Top observations for each finance sub-category from July 2013-2014:

• January holds the biggest uplifts for all categories, particularly for tax, credit card, investments and insurance - all up over 20% in search queries, compared to the annual average

• Credits cards also see an uplift in search queries earlier, in November, which may indicate that consumers are seeking credit for the festive period, ahead of anticipated spending

• We also see an uptick of 9% for insurance during October, with people showing interest in renewing their current premiums in the autumn

Overall, we see increased search activity during January for all sub categories – so it is most definitely a period that UK brands and advertisers should focus on looking to optimise their finance accounts!

3#: Showing up and being present - are you ready to do business across Mobile & Tablet as well as PC/Laptop?

According to Mintel, the percentage of the UK population who own a smartphone has increased from 56% in Jan 2012 to 72% in April 2014.

TGI have also looked into daily habits across Mobile. As you might expect, the majority of sites used are Search Engines, Social Networking, Email, Weather and News. If you delve deeper into those that require transactions, it’s revealed that 12.5% of Mobile use involves finances, with a further 2% being research into finance/business. Mobiles are becoming much more prominent in how we search and purchase.

The TGI and Mintel study findings tally nicely with what we are seeing across the Yahoo Bing Network, measuring September 2014 vs. 2013. Overall, on Yahoo Bing Network the UK we’re seeing very healthy growth:

- Finance clicks overall have grown +10%

- Tablet clicks are +51% and Mobile clicks +72%, year over year*.

- At the same time we’re seeing some competition, with CPCs up slightly higher at +14%; although not significant, we do recommend taking time to optimise bids during the finance season.

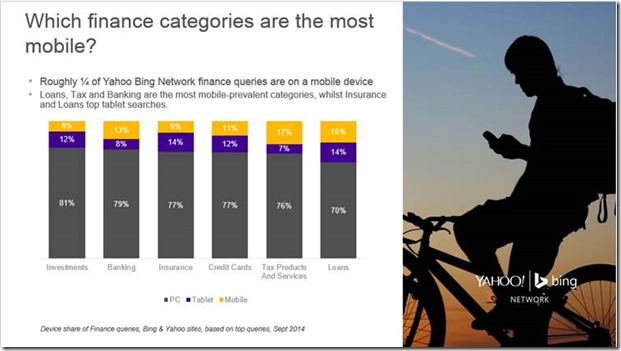

As Mobile becomes more influential in the way consumers purchase, the sub-categories within Finance and the relative share of queries for Tablet and Mobile, using September 2014 as an example:

- Around a quarter of finance queries are on a mobile device (including both Tablet/Mobile)

- Mobile is still higher than tablet, but interestingly both loans and tax are the most mobile categories in terms of queries

- Insurance and loans tie for the highest share of tablet searches

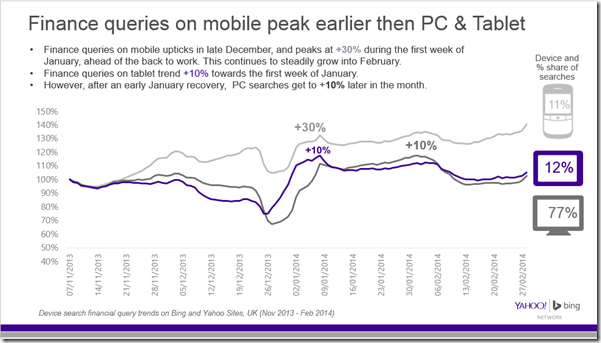

But what about when users use their devices to search for financial products? The below chart shows how the usage of each device evolves from November through to New Year and beyond, shown indexed to November. On the right-hand side, you can see a quick reminder of the device and percentage share of those search queries by each device.

What is interesting is that finance queries on mobile start to climb in late December and peak at +30% (vs. November levels) during the very first week of January, before the traditional break is even over. This then continues to steadily grow into February.

However, finance-related queries on PC reach +10% but slightly later than mobile in the second week in January. Tablets follow a similar pattern to mobile, but see a similar 10% peak, only right at the end of the month.

The key take away here is to make sure that you don’t forget to target mobile searchers starting in mid-December and continuing throughout January, particularly if your campaigns are loans, tax or credit card related. It’s also good to ensure that budgets are set to last throughout the January period, when tablet and PC searches remain strong.

4#: Talk the talk - communicate product offerings in a way that resonates with your target customer, and makes your ad stand out

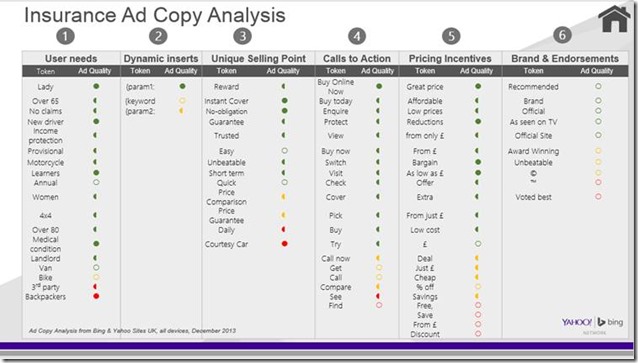

To ascertain how, we looked at ad copy running in December 2013, and have identified a number of ad copy tactics typically used to optimise ads in the finance vertical. We looked at whether including these tactics improved the ad quality, and differentiated the ad.

To make it easy to understand, we’ve rolled all of the individual keywords and tokens into token categories and analysed which sub-categories are the best and most effective differentiators for Insurance, credit cards and loans.

These tactics include (with some examples):

- Addressing user needs: over 65, new driver, landlords, poor credit, platinum

- Using dynamic inserts:

- Including unique selling points: cashback, points, no fees, approval in minutes

- Including calls to action: pick, apply, call, try, view, check, speed

- Including cost or pricing information: APRs, interest-free, 0%, Save, low rates, affordable

- Including brand names or endorsements: official, award-winning, ©, ™

![clip_image002[5] clip_image002[5]](https://advertiseonbing.blob.core.windows.net/blob/bingads/media/library/o/blogpost/december 2014/0184.clip_image0025_thumb_781b80c2.jpg)

Here are some tips to drive the best performing top ad copy tactics on the Yahoo Bing Network for finance:

- If focusing on Insurance campaigns and writing ad copy for a particular campaign, try recognising the user needs in your ad copy to make it stand out so that the consumer knows exactly what the insurance offering they are clicking on is designed for

- Dynamic text insertion and including unique selling points are good tactics to help make your ad stand out for both Insurance and credit cards

We highly recommend building and testing different ad copy combinations to find the strongest performing ad for your brand and product.

We’ve also created ‘ad creative heat maps’ for the top sub-categories, to help you zone in on the best language and tokens to use when writing ads. Below is an example of how to read the heat maps, but also the heat map for the Insurance sub-category:

![clip_image004[5] clip_image004[5]](https://advertiseonbing.blob.core.windows.net/blob/bingads/media/library/o/blogpost/december 2014/6557.clip_image0045_thumb_6e58a9fb.jpg)

To review the heat maps for Credit Cards and Loans, check out the deck on SlideShare, here.

That’s a wrap! UK Finance essential ‘go-dos’ for the New Year:

- Ensure that you are set up to capitalise on mobile searches from mid-December throughout January, particularly if your campaigns are Loans related. Participate in mobile if you have a mobile-ready website. Also via the new Tablet bid modifier within Bing Ads you can continue to tune your bids for optimum ROI (-20% to +300%). Make sure budgets are set to last throughout January and February.

- Try testing different ad copy strategies in December, and run with the best performing ads in January. Remember to test the recommended tokens for each finance category to help make your ads stand out.

- Finally maximise your presence. Consider Bing Ads ad formats such as Sitelink Extensions and Call Extensions, as they act as a great signpost to get potential customers to the products they care about quickly whilst making your ads larger and richer. Based on testing, Sitelink Extensions increases CTR by +16% on average, and they are now available on Mobile!

Thank you for reading, we hope you found these finance and Insurance Insights helpful! The above four tips are top-level tasters of what you may expect in the UK finance and Insurance marketplace this New Year. For more hints and tips you can review our complete findings by reading the deck hosted on SlideShare.

Cheers,

Kate